Managing Risks in Kenyan Real Estate

Managing Risks in Kenyan Real Estate

While there is no denying the potential of the Kenyan real estate market, many risks come with it just like any other investment. From legal complexities to vacancy handling and property maintenance, various issues can influence your financial outcomes. This guide discusses key strategies for overcoming these challenges, ensuring a secure investment journey. It also highlights how PrimeForce helps you manage risks on the road to success.

Key Risk Factors

- Market Fluctuations and Informed Decisions: The dynamic real estate market makes informed decisions crucial in reducing risks from market fluctuations. By researching property values, rental yields, and demand trends, you can target areas with strong investment potential. Analyzing market cycles and economic factors helps you determine the best timing for buying or selling properties.

- Legal Hurdles and Streamlined Processes: Verifying title deeds, checking for encumbrances, and ensuring regulatory compliance are vital steps. While PrimeForce does not offer legal advice, it simplifies the legal process. Additionally, PrimeForce's document storage feature allows you to store lease agreements, titles, and other documents securely, minimizing the risk of loss or misfiling.

- Diversification and a Balanced Portfolio: Diversification is key in Kenyan real estate. A diversified portfolio, including different property types (apartments, plots) and locations, protects your investment from market fluctuations. This strategy exposes you to various income streams, creates opportunities for capital appreciation in different areas, and allows you to control risk exposure according to your comfort level. PrimeForce supports a wide range of property types, enabling you to manage your portfolio from a single platform. You can track sales, oversee lease properties, and handle financial management needs for all your properties, regardless of location.

Building a Secure Future

Infrastructure and Development Insights

Investing in areas with significant infrastructure and development potential enhances your investment's value. Conduct thorough research to understand development plans that may impact property values. Engage with local professionals, including real estate agents and developers, and review industry reports to stay updated on upcoming infrastructure projects, commercial developments, and urban renewal initiatives. This positions you to make informed decisions regarding property location and potential.

Insurance & Risk Management

Property insurance protects against natural disasters and other accidents. Ensure your investment property is fully insured. When choosing insurance, consider the location, property type, and potential risks. Regularly update policies to ensure comprehensive coverage.

Regular Maintenance & Low Vacancy Rate

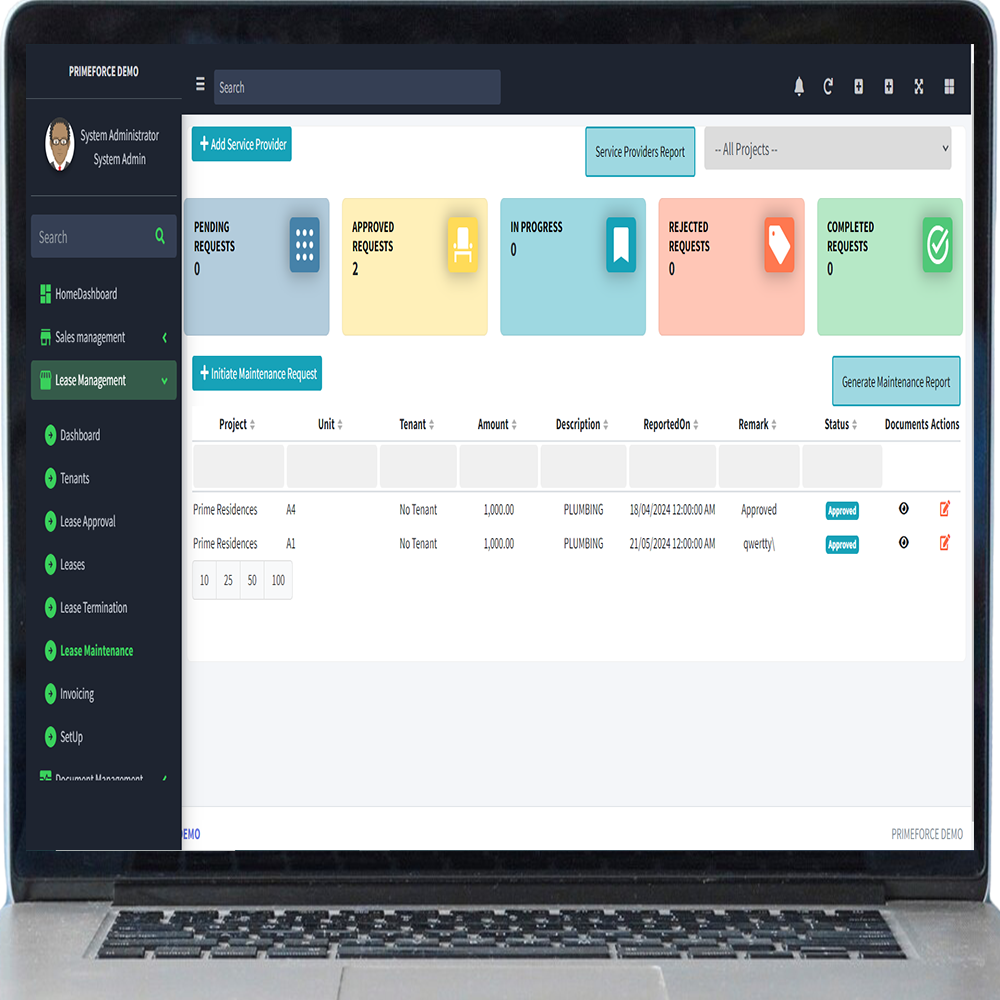

Regular property maintenance prevents value loss and reduces vacancy rates. Address minor issues before they escalate. Consider hiring reliable property management CRM that offer features like maintenance request management within the property management application. This allows tenants to request repairs easily, and you can track progress and resolve issues promptly. Efficient tenant communication via email, SMS, and WhatsApp ensures any problems are addressed quickly, reducing turnover. By responding efficiently to maintenance requests and keeping tenants informed, you create a positive experience that promotes longer stays and reduces vacancy rates.

The Bottom Line: Confidently Invest

With PrimeForce, you have automated tools to limit risk exposure and succeed in the Kenyan real estate market. PrimeForce streamlines property management, reduces workload, and provides the data needed for informed decision-making. Ready for smarter investing? Get a free trial of PrimeForce today!